vehicle sales tax san antonio texas

You can find these fees further down on. Northwest - 8407 Bandera Rd.

Sapd Teen Arrested For Manslaughter After Accidentally Shooting Man In Head Killing Him

If buying from an individual a motor vehicle sales tax 625 percent on either the purchase price or standard presumptive value whichever is the highest value must be paid when the vehicle is titled.

. The City of San Antonio has an interlocal agreement with the Bexar County Tax Assessor-Collectors Office to provide property tax billing and collection services for the City. This is the total of state county and city sales tax rates. Did South Dakota v.

The current total local sales tax rate in San Antonio. San Antonios current sales tax rate is 8250 and is distributed as follows. The County sales tax rate is.

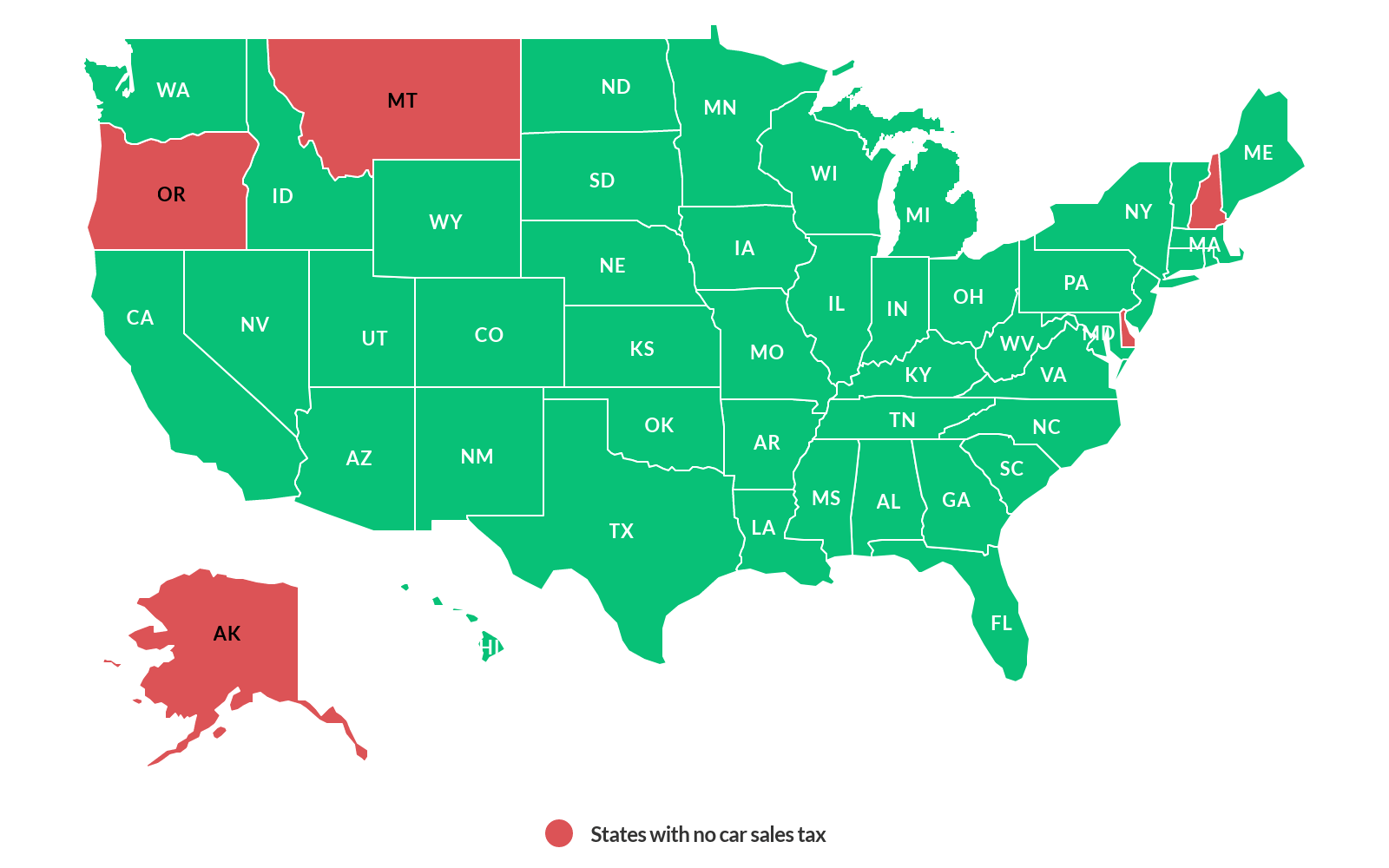

1000 City of San Antonio. New Texas residents pay a flat 9000 tax on each vehicle whether leased or owned when they establish a Texas residence. Congratulations to San Antonios Fiesta texas comptroller glenn hegar made a stop at the University of Texas at San Antonios National Security Collaboration Center 9 Seven states exclude car rentals from state sales taxIllinois Kentucky Maine Maryland Texas Vermont and Virginia.

The Texas Comptroller states that payment of motor vehicle sales taxes has to be sent to the local countys tax assessor-collectors office by sending a signed copy of the Application for Texas Title andor Registration form Form 130-U. What Is The New Car Sales Tax In San Antonio Texas. Motor Vehicle Sales and Use Tax.

0125 dedicated to the City of San Antonio Pre-K 4 SA initiative. Restaurants In Matthews Nc That Deliver. Even if you purchased your new car in a different state you will pay sales tax for the state where you register the vehicle.

Please direct these items to the new city tower location city of san. Multiply the net price of your vehicle by the sales tax percentage. SPV applies wherever you buy the vehicle in Texas or out of state.

Opry Mills Breakfast Restaurants. The oldetst car on the lot was a 2009All late model cars and none of the cars that I looked at had more than 30k miles. Application for Texas Title andor Registration Form 130-U Texas Motor Vehicle Transfer Notification VTR-346 Affidavit of Motor Vehicle Gift Transfer Form 14-317 Application for Persons with Disabilities Parking Placard andor License Plate VTR-214 Application for Certified Copy.

Find your states vehicle tax tag fees when purchasing a vehicle the tax and tag fees are calculated based on a number of factors including. There is no applicable county tax. Texans who buy a used vehicle from anyone other than a licensed vehicle dealer are required to pay motor vehicle sales tax of 625 percent on the purchase price or standard presumptive value SPV whichever is the highest value.

Some dealerships may charge a documentary fee of 125 dollars. Remember to convert the sales tax percentage to decimal format. Are Dental Implants Tax Deductible In Ireland.

In addition to taxes car purchases in Texas may be subject to other fees like registration title and plate fees. The sales tax for cars in Texas is 625 of the. The San Antonio Texas general sales tax rate is 625.

0125 dedicated to the City of San Antonio Ready to Work Program. There is no applicable county tax. 0500 San Antonio MTA Metropolitan Transit Authority.

Northeast - 3370 Nacogdoches Rd. San antonio texas sales tax rate details. Counties cities transit and special purpose districts have the option to impose additional local sales and use.

4 rows San Antonio TX Sales Tax Rate. 0250 San Antonio ATD Advanced Transportation District. The title registration and local fees are also due.

Please allow up to 15 days for the processing of your new window sticker or new plates by mail. What is the sales tax rate in San Antonio Texas. The modified vehicle must be used at least 80 percent of the time to transport or be driven by a person with.

Car loan rates as low as 179 apr in san antonio. Texas collects a 625 state sales tax rate on the purchase of all vehicles. Southside - 3505 Pleasanton Rd.

Bexar County Tax Assessor-Collector Office. The Texas sales tax rate is currently. Forms from the Texas Department of Motor Vehicles include.

Depending on the zipcode the sales tax rate of San Antonio may vary from 63 to 825. TX Sales Tax. Texas has a state sales tax rate of 625.

625 on the purchase price if purchased from an authorized dealer. For questions regarding your tax statement contact the Bexar County Tax. The State of Texas imposes a motor vehicle sales and use tax of 625 of the purchase price on new vehicles and 80 of the Standard Presumptive Value non dealer sales of used vehicles.

If purchased from anyone other than an authorized dealer it may be 625 of the purchase price or 625 of the SPV whichever is higher. 625 on the purchase price or Standard Presumptive Value SPV. The minimum combined 2022 sales tax rate for San Antonio Texas is.

Restaurants In Erie County Lawsuit. 4 rows The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125. The 825 sales tax rate in San Antonio consists of 625 texas state sales tax 125 San Antonio tax and 075 Special tax.

While tax rates vary by location the auto sales tax rate typically ranges anywhere from two to six percent. San Antonio TX 78283-3950. Majestic Life Church Service Times.

San Antonio TX 78201. Send your renewal form and a photocopy of proof of insurance to. Cars vans trucks and other vehicles are subject to motor vehicle sales and use taxMotor vehicles are exempt from tax if they are modified to be used by someone with orthopedic disabilities to help them drive or ride in the vehicle.

According to the Texas Department of Motor Vehicles any person that buys a car in Texas owes the government a motor vehicle sales tax. This place is great. The sales tax for cars in Texas is 625 of the final sales price.

A vehicles SPV is its worth based on similar sales in the Texas region. You can print a 825 sales tax table here. The San Antonio sales tax rate is.

Vehicle registrations may also be renewed by mail. The san antonio sales tax rate is. Dealer during the preceding tax year and the dealer estimates that the dealers total annual sales from the dealers motor vehicle inventory less sales to dealers fleet transactions and subsequent sales for the 12-month period corresponding to the current tax year will be.

What is the sales tax on a new car in San Antonio Texas.

Living In San Antonio 40 Things You Need To Know Before Moving Here Bhgre Homecity

World Car Kia North San Antonio Tx New Used Kia Dealer

Texas Sales Tax Small Business Guide Truic

World Car Kia North San Antonio Tx New Used Kia Dealer

World Car Kia North San Antonio Tx New Used Kia Dealer

Is Buying A Car Tax Deductible Lendingtree

Texas Car Sales Tax Everything You Need To Know

World Car Kia North San Antonio Tx New Used Kia Dealer

Texas Used Car Sales Tax And Fees

How To Renew Your Car Registration In Texas Yourmechanic Advice

Long Term Relationships 15 Vehicles Owners Hold Onto For 15 Or More Years

Map See All 160 Homicides In San Antonio In 2021 Highest In 27 Years

Texas Auto Title 418 N General Mcmullen Dr San Antonio Tx Real Estate Developers Mapquest

Certified Toyota Dealer San Antonio Tx Serving Boerne New Braunfels